By Özge Taylan

As the world’s 18th and Europe’s 7th largest economy, a dynamic member of the G-20 and part of the OECD, the Turkish economy has become very active compared to its lagging status in the 1990s. It has often been cited[1] as one of the best-performing, emerging economies in the world. Despite its fair share of ups and downs since 1980s, Turkey has managed to grow and has undergone major changes over the past two decades. But how exactly is Turkey’s economy doing today?

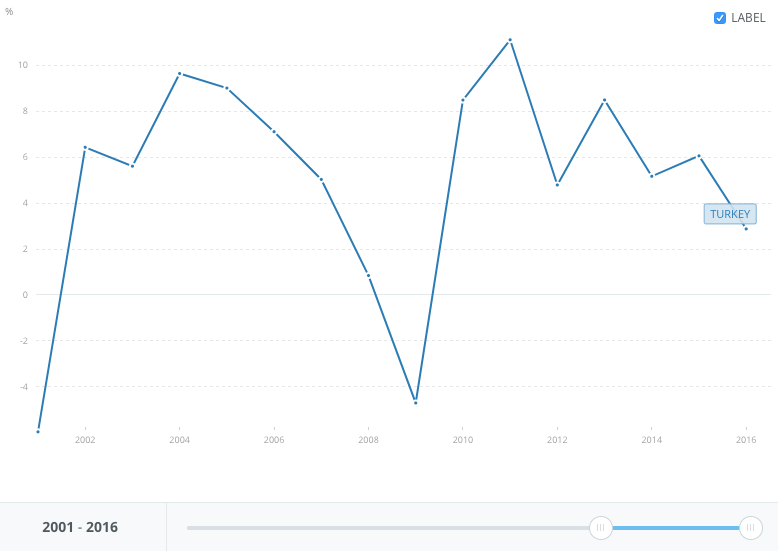

The rapid development of the Turkish economy during the period of 2001-2008 came to an end after the 2008 financial crisis. While the economy grew in the period of 2010-11, it was incremental compared to earlier growth, and has since hit its most difficult period post-2012. The causes for these ups and downs are varied; the domestic outlook, foreign policy and Turkey’s precarious geopolitical position are important parts of the picture.

Perhaps the earthquake that struck Marmara in August 1999 was an omen. In retrospect, until the 2001 economic crisis, Turkey’s attempt to catch up economically with neighboring economies in the EU had occurred in an era of volatility and weakness. The 1990s was a politically unstable period in which the state’s role in the economy grew considerably. Funding opportunities were devoted disproportionately to the public sector, which in turn exposed the private sector to seriously detrimental, exclusionary effects. Necessary balancing reforms were postponed by endemic political instability, which together with the accumulation of fiscal and financial problems, led to the “Twin Crises” of November 2000 and February 2001.

The first crisis exploded on November 22nd 2000[2] after portfolio losses, liquidity problems and loss of confidence amassed within the banking system. As these issues came to light, the financial sector became increasingly vulnerable, and the Turkish Lira fell by 30%.[3] Together with political instability, high interest rates, and the Marmara Earthquake, the result was a substantial loss of output. The economy contracted by over 9% in 2001, the nation’s most severe recession since World War II.[4]

The biggest economic crisis in the history of the Republic was soon to follow. The February 2001[5] crisis caused capital and budget deficits that could not be financed and many companies in the real economy collapsed. Thousands of jobs were lost.[6]

The second of the “Twin Crises” may be characterized as the catalyst for a new era of Turkish political economy. For the first time in modern history, Turkish policymakers embarked on a set of substantial and sustainable reforms[7] of institutions underpinning the regulatory state. After a series of reforms, a decade of political stability, large budget deficits, high rates of inflation, and a large loan from the IMF, Turkey managed to achieve rapid growth between 2001 and 2008.

Figure 1: GDP Growth (annual %)

The 2008 financial crisis triggered by disruptions in the US mortgage system hit Turkey. However, it can be said that the country survived the crisis relatively easily. During the crisis, while many countries’ economies were shrinking, the Turkish economy managed to catch up with growth rates of 9.2% and 8.5% in 2010 and 2011[8], respectively. However, Turkey could not avoid a major economic recession with growing unemployment rates. This time, Turkey did not ask the IMF for help because it felt it could quickly recover from the crisis. The IMF acknowledged Turkey’s effective domestic policy response,[9] and the OECD also reported that “Turkey’s economic growth was likely to be among the strongest of OECD countries in 2010, supported by financial stability, international investor confidence and a dynamic business sector.”[10]

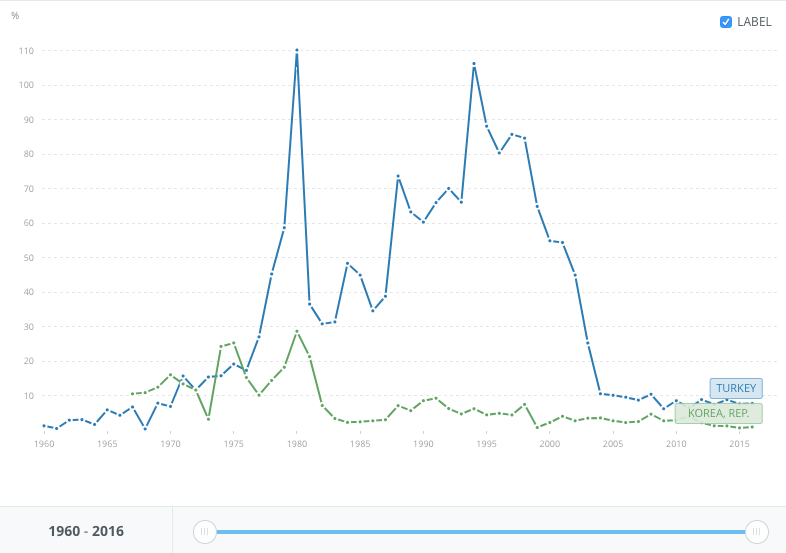

Even though the Turkish economy has been growing, its growth arrived relatively late compared to other developing countries, central reasons being its inability to halt its chronically high inflation, its current deficit and troublesome unemployment rates. Though Turkey’s economy was catching up with other developing countries along certain indicators like GDP growth, it was actually significantly weakened due to inflation. The realization of economic growth together with price stability and low inflation constitute one of the fundamental objectives of the economic policy of the Justice and Development Party (AKP) since 2002. In many ways, Turkey can be compared to South Korea. Both countries found themselves in similar situations after WWII – agriculture-based, war-damaged, and oil-free – but now, South Korea is one of the largest economies in the world. Turkey on the other hand, has experienced dramatic fluctuations in inflation. Turkish economy does grow despite high inflation, but it also becomes more volatile. Despite a relative stabilization after 2005, inflation still remains high, hampering economic growth.

Figure 2: Inflation, consumer prices (annual %)

When the single ruling party in Turkey, the Justice and Development Party (AKP), came to power in 2002, its policy priorities were to increase Turkey’s reputation and role in world politics via a pro-western stance and closer relations with the EU. It also sought to provide macroeconomic stability by reducing its debt and boosting the economy.

As for the first policy goal, the EU and the IMF are important building blocks of the Turkish political economy. Particularly, the EU serves as a facilitator of Turkish economic growth and societal change towards meeting international norms, such as human rights and democratic mores. The conservative democratic party of AKP, by its own admission, has committed to joining the EU, to becoming a full democracy, and to liberalize its economic policy. Negotiations with the EU immediately began upon the AKP’s ascendency. The determination of EU membership and efforts to improve Turkish relations with neighboring countries were signals of the beginning of a new era. Turkey has come a long way towards harmonizing their political, economic and social policies with the Copenhagen Criteria. Nevertheless, the ambitious pro-EU rhetoric of AKP’s first period has faded, to which some have attributed the economic standstill today.

Tense relations with certain EU countries play a pivotal role in this standstill period. For instance, Turkey’s relationship with Germany has been fragile particularly after the July 15, 2016 coup d’état attempt in Turkey. Since then, both sides have blamed each other on many issues like Germany’s refusal on Turkey’s demands for the extradition of Turkish officers who took part in the coup attempts, detention of German citizens in Turkey, and tension over Incirlik Air Base.[11] Still, tense relations persist. However, further disruptions to diplomatic relations and agreements would likely affect Turkey’s economy the most. Escalating bilateral political tensions have created uncertainty for Turkish and German companies so much that trade volume will likely fall by 2 billion Euros in late 2017.[12] With Angela Merkel in power for the next few years, it is likely that it will be much of the same. To be frank, an ultimate rupture of all relations would not be an unreasonable choice for both sides. Enduring solutions depend on political reconciliation and long-term trade relations, not on a cycle of attrition, which seems likely without a drastic change. Thus, it can be suggested that re-engagement will definitely generate sizable economic gains for both sides.

As for the IMF, the first stand-by agreement between Turkey and the IMF coincided with the beginning of Turkish relations with the EU. Signed in 1961, Turkey has since become one of the top-three countries to demand IMF resources. For example, during the 2001 economic crisis Turkey had to take radical measures due to the dramatic reduction of GDP by over three quarters and the total revenue loss of 6% GDP.[13] With another stand-by made in 2002, IMF provided 19 billion dollars.[14] The Government’s response to the Crisis was a new program called as Transition to the Strong Economy Program (TSEP) backed by the IMF that reduced public borrowing, implemented structural reforms including fiscal and monetary policies, and more importantly restored the banking sector. Since the Twin Crises caused a significant erosion of the capital base of the banking sector, in order to recover the fragility of the banking sector, key strategies under the slogan of “Strong Economy and Sound Banking” were adopted. For example, a deep financial restructuring of state and Savings Deposit Insurance Fund banks; measures to facilitate the participation of private capital in the strengthening of the private banking system; and, a further improvement of banking regulation and supervision.[15] These strategies were successfully realized to establish a sound banking sector in Turkey, and they can be considered the reason as to why the 2008 crisis was so easily overcome.

Lastly, Turkey’s economy is greatly affected by its geopolitical position and the long-term political instability of its many neighbors. Since the 2012 Arab Spring, concerns have increasingly been voiced regarding the Turkish economy. The Arab Spring and the Syrian crisis afterwards, like the entire Middle East region, have directly and indirectly influenced Turkish politics, security, diplomacy and economics. Before the Arab Spring, Turkey attempted many bilateral relations with its neighbors. Moreover, through the activist foreign policy of the AKP government, Turkey formed voluminous trade relations with Middle Eastern countries, took steps to ease the nuclear crisis between Iran and the West, mediated peace talks between Israel and Syria, signed oil and natural gas investment deals, and the Israel–Palestine conflict. The AKP, which adopted a policy of “zero problems with neighbors”[16], gave special importance to Syrian relations in its overall Middle East strategy. Political relations developed with mutual high-level visits, along with trade, tourism, customs, agriculture, transportation, and cultural exchange. With the sudden burst of the Arab Spring, all these initiatives came to a standstill; particularly, the trade flows and volume with the Spring countries decreased and firms’ investments were adversely affected. Even though Turkey has been active and assertive in her foreign policy as in the economic affairs, she has confronted the challenges in the Middle East, which led critics to claim that the AK Party government’s “zero problems with neighbors” vision has failed in the Middle East front.[17]

The most important effect that the Arab Spring had on Turkish politics and economy is undoubtedly the immigration issue that leads to radical changes in the socio-economic structure of the hosting country. According to UNCHR’s September 2017 report, in Turkey, the number of registered Syrian refugees is over 3 million.[18] Turkey’s economic, social and political environment has changed under this influx. According to recent research, Syrian refugees have put more than 8 billion dollars into the Turkish economy and could yearly increase per capita income growth by 0.2-0.3 percent, which could lower inflation even at the regional level.[19] However, statistics do not account for everything. Though refugee entry has had a stimulating effect on the Turkish economy, the issue is multidimensional – humanitarian, political, and legal. The turmoil in Syria and subsequent refugee issue has led to trade loss, and rent and house prices have skyrocketed. Unemployment is high and inflation is rising in border cities.[20] Furthermore, the increase in the number of Syrian child workers, shanty settlements, and disruptions to social harmony have made local developments difficult, and ultimately fostered a vicious cycle of economic decline. Since this issue puts a heavy strain on public services and therefore expenditures, other actors – whether international organizations or countries – who have advocated solidarity and burden-sharing principles should take steps to lessen the burden on Turkey.

In sum, after a decade of a more inward-looking economy in the 1990s, since 2001, Turkey has managed to open its economy and avoid taking hard hits from risky domestic, regional and global instabilities. The Turkish economy is facing severe pressure on several fronts made more difficult by the geopolitical situation in neighboring countries plagued by civil wars, sectarian conflict and the initiation of cross-border military operations in Syria. On a domestic level, the Turkish economy has also taken hits from the increasing occurrence of violent terror attacks, the attempted 2016 Turkish coup d’état, and diplomatic crises with other countries that directly affect the economy. All of this has led Turkey to increase its military and defense spending by 9.7 per cent between 2007 and 2016[21], which indeed has put pressure on the budget. Despite these troubles, the Turkish economy has progressed relatively well in figures. In September 2017, the Turkish Statistical Institute (TUIK) reported year-on-year second-quarter GDP growth as 5.1%.[22] According to the macroeconomic indicators, Turkey has tripled its per-capita income, its GDP increased by 360%, and it achieved an average growth rate of 4.8 %.[23] These are good signs. However, domestic and external factors increase the vulnerability of the Turkish economy and have negative spillover effects on economic growth. For this reason, Turkey needs to implement economic structural reforms in order to solve the chronic inflation and high current account deficit problems. The country must achieve political stability, reinforce strong external anchors, and establish stable bilateral economic ties in line with fundamental interests and foreign policy principles based on mutual trust.

[1]Available at: http://www.worldbank.org/en/news/feature/2014/12/10/emerging-turkey-lessons-from-economy-in-transition

[2] For more information, please see: OZATAY, F. & SAK, G. (2002). The 2000-2001 Financial Crisis in Turkey. Available at: https://www.researchgate.net/publication/242034963_THE_2000-2001_FINANCIAL_CRISIS_IN_TURKEY

[3] Available at: http://oecdobserver.org/news/archivestory.php/aid/435/Turkey_s_crisis.html

[4] Available at: http://www.hurriyet.com.tr/kriz-2-dunya-savasi-kadar-sarsti-ilk-ceyrekte-ekonomi-yuzde-13-8-kuculdu-11977246

[5] For more information, please see: YELDAN, E. Behind the 2000/2001 Turkish Crisis:

Stability, Credibility, and Governance, for Whom? Available at:

http://yeldane.bilkent.edu.tr/Chennai_Yeldan2002.pdf

[6] European Commission Economic Papers, (2009). Growth and economic crises in Turkey: leaving behind a turbulent past?, p.6 Available at: http://ec.europa.eu/economy_finance/publications/pages/publication16004_en.pdf

[7] Available at: http://siteresources.worldbank.org/EXTPREMNET/Resources/489960-1338997241035/Growth_Commission_Workshops_Macroeconomic_Financial_Policies_Dervis_Paper.pdf

[8]Available at: http://www.mfa.gov.tr/prospects-and-recent-developments-in-the-turkish-economy.en.mfa

[9] Available at: http://www.mepc.org/turkeys-graduation-international-monetary-fund

[10] Available at: http://www.oecd.org/home/0,2987,en_2649_201185_1_1_1_1_1,00.html

[11] DEDEOGLU, B. Who benefits from tension, Turkey or Germany. Available at: https://www.dailysabah.com/columns/beril-dedeoglu/2017/07/25/who-benefits-from-tension-turkey-or-germany

[12] Available at: https://www.reuters.com/article/us-germany-turkey/top-merkel-aide-says-turkeys-conduct-unacceptable-idUSKBN1A80G6

[13] DEMIROGLU, U. (2013). The Effects of the Investment Decline on Potential GDP in Turkey’s 2001and 2009 Crises, Central Bank Review, 13, pp-25-44, p.25. Available at: http://www.tcmb.gov.tr/wps/wcm/connect/5cc05f6a-ad0a-4a6f-aff3-73099722b5f6/sep13-2.pdf?MOD=AJPERES&CACHEID=ROOTWORKSPACE5cc05f6a-ad0a-4a6f-aff3-73099722b5f6

[14] Available at: https://www.imf.org/external/np/loi/2001/tur/04/index.htm

[15] Available at: https://www.bddk.org.tr/WebSitesi/english/Reports/Other_Reports/2651BSRP_Progress_112002.pdf

[16] Available at: http://www.mfa.gov.tr/policy-of-zero-problems-with-our-neighbors.en.mfa

[17] Available at: http://www.insightturkey.com/a-golden-age-of-relations-turkey-and-the-western-balkans-during-the-ak-party-period/articles/1401

[18] Available at: http://data.unhcr.org/syrianrefugees/country.php?id=224

[19] Available at: http://www.bbc.com/turkce/haberler/2016/05/160509_turkiye_multeciler_buyume

[20] Available at: http://www.hurriyetdailynews.com/syrian-refugee-inflow-doubles-house-prices-in-turkish-border-cities.aspx?pageID=238&nID=63204&NewsCatID=345

[21] SIPRI Fact Sheet, April 2017, p.7. Available at: https://www.sipri.org/sites/default/files/Trends-world-military-expenditure-2016.pdf

[22] Available at: www.tuik.gov.tr/PreHaberBultenleri.do?hbid=43

[23] Available at: www.tuik.gov.tr/PreIstatistikTablo.do%3Fistab_id%3D2218+&cd=2&hl=tr&ct=clnk&gl=kr

- “I Love My Body”: Hwasa and Female Empowerment in K-Pop and Korean Society - May 6, 2025

- English Fever in South Korea - February 24, 2025

- South Korea’s Medical School Expansion – Cure Worse than the Disease? - October 20, 2024