The world today views South Korea as the ‘mecca’ of technological advancement, modernity and holistic development. The miracle of the Han River is metaphoric to showcase South Korea’s rise to a developed nation within the shortest span post the devastating war in the Korean Peninsula.

However, ironic to South Korea’s staggering socio-economic success, according to the latest Corporate Governance (CG) Watch 2020 report as published by the Asian Corporate Governance Association, South Korea is said to have ranked 9th out of 12 Asia-Pacific countries, including Australia, with a score of 52.9 percent. This survey is conducted every two years to evaluate the macro corporate governance quality in 12 markets in the Asia-Pacific region. Korea was initially at the 6th rank in 2007 but subsequently fell to 9th in 2010 and has been said to have consistently ranked 8th or 9th since.

What is Corporate Governance?

Corporate governance is the science of applying robust framework, policies, practices, and processes to ensure the strategic optimal functioning of a firm. It essentially involves balancing the interests of a company’s multiple stakeholders: the shareholders, senior management executives, customers, suppliers, financiers, the government, and the community.

Numerous factors, like the composition of the board members, stock option distribution patterns amongst shareholders, management policies affect the Corporate Governance of a company, which is then numerically reflected in their stock fluctuations.

Why is the status of Korea’s Corporate Governance stagnant?

1) Skewed Representation of Women in Top Management & Leadership Role

In a study surveying 500 Korean companies based on income, it was revealed that women executives make up 2.7% of total executives; among those 500 companies studied; 31 of them had only 4 women board members (1.6%) out of total 245 members and 27 companies did not have a single woman board member. As a result, Korea supposedly has among the lowest women representations in senior roles, boards, and executive committees both in Asia and in the world. According to another survey of 2,246 stock market-listed companies in the first quarter of 2021, only 1,668, or 5.2%, of the 32,005 executives were women, as reported by the Ministry of Gender Equality and Family, Government of Korea.

Studies, on the contrary, have shown a positive relationship between women leadership roles and Company performance. Reports have supposedly found that companies with boards that have more than 30% female representation are associated with higher returns on assets and returns on equity compared with companies that have all-male boards. Apple Inc. has a 27% female representation in the Board, while Amazon Inc. has over 45% female representation in their Board of Directors.

2) Malpractices, Embezzlement and Fraud

Fraudulent money laundering and other malpractices are allegedly widely prevalent in the Korean corporate world. Osstem Implant Inc. was in the news early this year after one of their employees allegedly embezzled 188 billion KRW of corporate funds. This amounts to about 91.8% of the company’s 204.7 billion KRW of equity capital and is estimated to be the highest ever in the case of embezzlement at a listed company. According to Korea Securities Depository, retail investors and 19,856 minority stakeholders of Osstem Implant who own 55.57 percent of the shares were the most affected. Prioritising on shareholder and stakeholder interest is the key aim of corporate governance which gets tarnished by such embezzlement malpractices.

Source: Korea JoongAng Daily

Similarly, back in 2017, the Founder of Lotte Group, Shin Kyuk-Ho was sentenced to four years in prison for embezzlement. In January 2021, the South Korean government officially established the Corruption Investigation Office for High-Ranking Officials (“CIO”) with the aim to investigate corruption involving current and former senior officials, including lawmakers, prosecutors, judges, presidents, prime ministers, as well as their family members. While the implementation of the CIO is expected to curtail the negative impact of corruption under the power wielded by the prosecutor’s office, in all practicality it has limited authority to prosecute most of the cases it investigates. Technically, the CIO can only initiate prosecutions of prosecutors, judges, and high-ranking police officers. In cases of investigations involving other high-ranking officials, the CIO is obligated to submit its findings to the ‘Supreme Prosecutor’s Office’ (SPO), and the SPO presides on whether or not to initiate a prosecution. The CIO’s own proceedings on investigations, which include superseding the prosecution’s power over indictment in certain cases, have drawn backlash from prosecutors who believe that these rules grant the CIO excessive power.

3) Militarised Organisational Culture

Owing to Korea’s tormented political history of wars, other causes for Korea’s stunted development in Corporate Governance could be attributed to their militarised structure of hierarchy and organisational culture, which supposedly inhibits freedom of expression and bears rigidity to change. The Korean corporate continues to value age and tenure over competence in promotions, thereby enabling the power of the organisation being concentrated at the apex with few old visionaries. Until 2011, several reports have indicated that South Korea’s CEOs maintained an age average of 57.6 years or more. While it is well appreciated that an experienced CEO might help a company avoid repeating mistakes, it is important to also consider that the flexibility of youth might be important in an environment of quick adjustments. Korean youth have continued to express their displeasure with the country’s ‘notoriously punishing’ work culture. Their complaints pertain to the culture of ‘gapjil (갑질) and ggondae (꼰대)’, the authoritarian attitude of senior executives who abuse their power to shout at their subordinates, insist on unpaid overtime and weekend work, assign personal errands, and force juniors to go out drinking for hours upon hours. Lack of structure, mis-managed communication, and poor management eventually compel several to quit their jobs in utter dismay. Researchers today, also attribute causes of the stark drop in fertility rate to South Korea’s disappointing job environment amidst other reasons like sky soaring high housing and living standards.

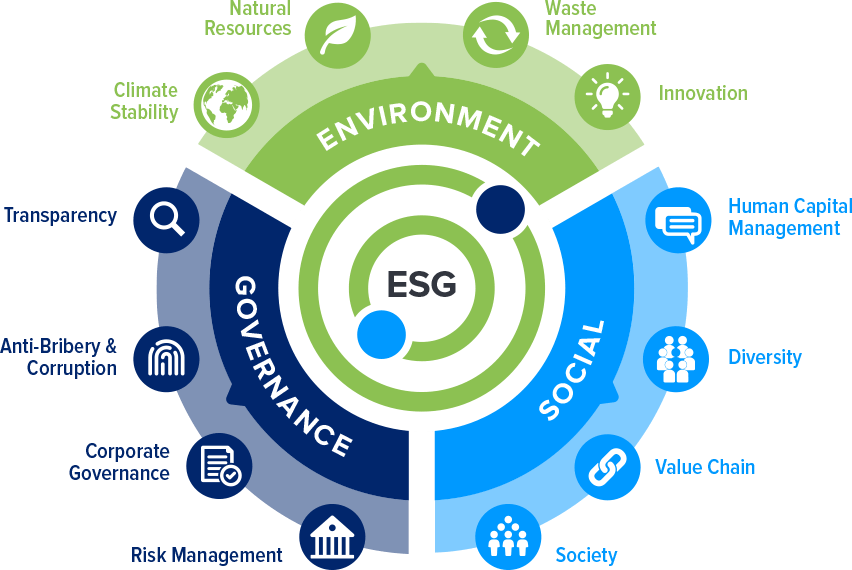

4) ESG Investment Status of South Korea

The world today is collectively facing threats of climate change or other environmental limits to growth. Thus, the expansion of Environmental, Social and Governance (ESG) investment and green infrastructure is a crucial challenge to be addressed for sustainable development and growth. Therefore, ESG is viewed as the holistic standard in assessing the corporate governance strength of an organisation. Korea’s developmental legacy has allowed it to reshape its financial market and investment habits to quickly expand its ESG market. Korea’s rich advancements and technical know-how augment their ESG compliance capacities and make them a more attractive destination for sustainable infrastructure investments. Additionally Korea’s significant presence in the Asia-Pacific region as a major creditor and exporter induce ESG investment from its private sector as well. However, presently the market’s heavy reliance on government agencies for finance and ad hoc pandemic response based investments do raise a few questions on South Korea’s dwindling stance on ESG adherence; the increasing global interest in the ESG market makes it likely that the Korean government will continue to incentivize its focus on ESG principles.

Source: Safetymint.com

“The ray of Hope”

Naver Corporation recently went through a drastic C-Suite makeover by declaring 40-year-old Harvard Law School-graduate, Ms. Choi Soo-Yeon, as their CEO. Similarly, Mr. Kim Nam-Sun, the 43-year-old director of Naver’s M&A businesses, who also went to Harvard Law School, was declared as their Chief Financial Officer (CFO).

Source: 네이트뉴스

Not just in Naver Corp, but overall in the South Korean corporate world, the status of women participation is also gradually showing improvement. The Federation of Korean Industries (FKI) released a study on the status of women CEOs in Korea. The study, which was conducted on KOSPI and KOSDAQ -listed companies, found that the ratio of women CEOs to all CEOs steadily increased from 2.8 percent in 2015 to 3.6 percent in 2019. In 2015, there were only 75 women CEOs out of the total 2,716 CEOs at listed companies. In 2019, that figure rose to 115 out of 3,187. The FKI study has also found that the ratio of women high-ranking company officers to all high-ranking company officers has been on the rise. While this figure is still low in comparison to several global counterparts, it is speculated to be a warranted positive change in the right direction.

Concrete measures in protecting the ESG principles are also evident in recent times. The FSC and the Korea Exchange (KRX) launched an integrated ESG information platform in December 2021, providing a convenient one-stop information service on ESG-related information of listed companies for investors and the general public. The authorities expect that the ESG information platform will function as an important information hub for ESG-related data and help raise overall awareness on the importance of the ESG movement. The FSC and the KRX will continue to work on making improvements to the platform to help enhance user convenience and expand the types of ESG data made available through the platform.

As per the Corruption Perception Index (CPI) released by Transparency International (TI) on 25th January 2021, South Korea’s position rose by 19 ranks from 51st 2017 to the 32nd position among 180 countries by receiving a record high score of 62 points out of 100. Denmark, Finland & New Zealand topped the chart, emerging as the least corrupt countries. In addition to that, South Korea was ranked 18th out of 114 countries and 1st among Asian countries in the 2021 Index of Public Integrity (IPI), recently released by the European Research Centre for Anti-Corruption and State-Building (ERCAS). The Anti-Corruption and Civil Rights Commission (ACRC) attributes these positive results to the efforts of the government and the people to propagate an anti-corruption and integrity culture based on transparency and openness. This is a major step towards eradicating the vice of malpractices and corruption that erode an organisation from its roots.

These crucial waves of changes reflect that Korea’s corporate world is now resculpting itself. Harnessing its cutting-edge technology, unparalleled infrastructure and path-breaking know-how, coupled with a will to configure corporate policies strategically to enhance stakeholder interest, garners the potential to metamorphose South Korea into a global leader with a robust corporate governance framework in the near future.